Slash your tax

It’s quick, easy and affordable

Tax Depreciation Schedules

Property Returns specialises in preparing tax depreciation schedules for:

Residential Property – Newly built, Off the plan, Renovated, Short Term and Holiday Rentals (Air BnB)

Commercial Buildings – Low / High Rise, Offices, Office fit outs and Renovations

Business Purchases – Franchises, Hotels, Child care centres, Hospitality, Manufacturing and Industrial

We guarantee you will claim the maximum legitimate deductions and increase your cashflow.

For a once-off fee, you can order online

Residential Property

Newly built, Off the plan, Renovated, Short Term and Holiday Rentals (Air BnB)

Commercial Buildings

Low / High Rise, Offices, Office fit outs and Renovations

Business Purchases

Franchises, Hotels, Child care centres, Hospitality, Manufacturing and Industrial

Depreciation Service

“Our ATO approved schedule will cover the lifetime of your property or business purchase.

You will save on accounting fees and claim maximum deductions…

giving you more cash to grow your property portfolio”

Depreciation Process

Every property is unique, whether it is commercial or residential. The depreciable assets of each property age differently over time and any additions or changes are subject to the decisions of its owner. The ATO has specified a plethora of rules to account for the depreciation of assets. At Property Returns we are thorough in our understanding of the story behind each property to maximise tax savings.

We have developed a very streamlined process to prepare tax depreciation schedules. The first step is to gather all relevant data relating to the property purchase, historical information surrounding the building structure and all associated improvements to it. We do this by a detailed questionnaire to our clients, searching online government and real estate databases, using satellite impressions and strata plans for more accurate building measurement and physical inspections of the property. This process enables Property Returns to produce the most accurate depreciation schedules for our clients that maximise the tax savings for the lifetime of the property ownership in accordance with the ATO guidelines.

A Tax Depreciation Schedule / Quantity Surveyors Report reduces an investor’s current year’s income on their property.

The depreciation claimed is added back to the cost basis of the property when it is sold. Since the majority of

Australian investors are looking for a long- term commitment when purchasing property, depreciation

claims will maximise your property’s monthly cash flows and aid you to pay off your loan more quickly

What is a Tax Depreciation Schedule?

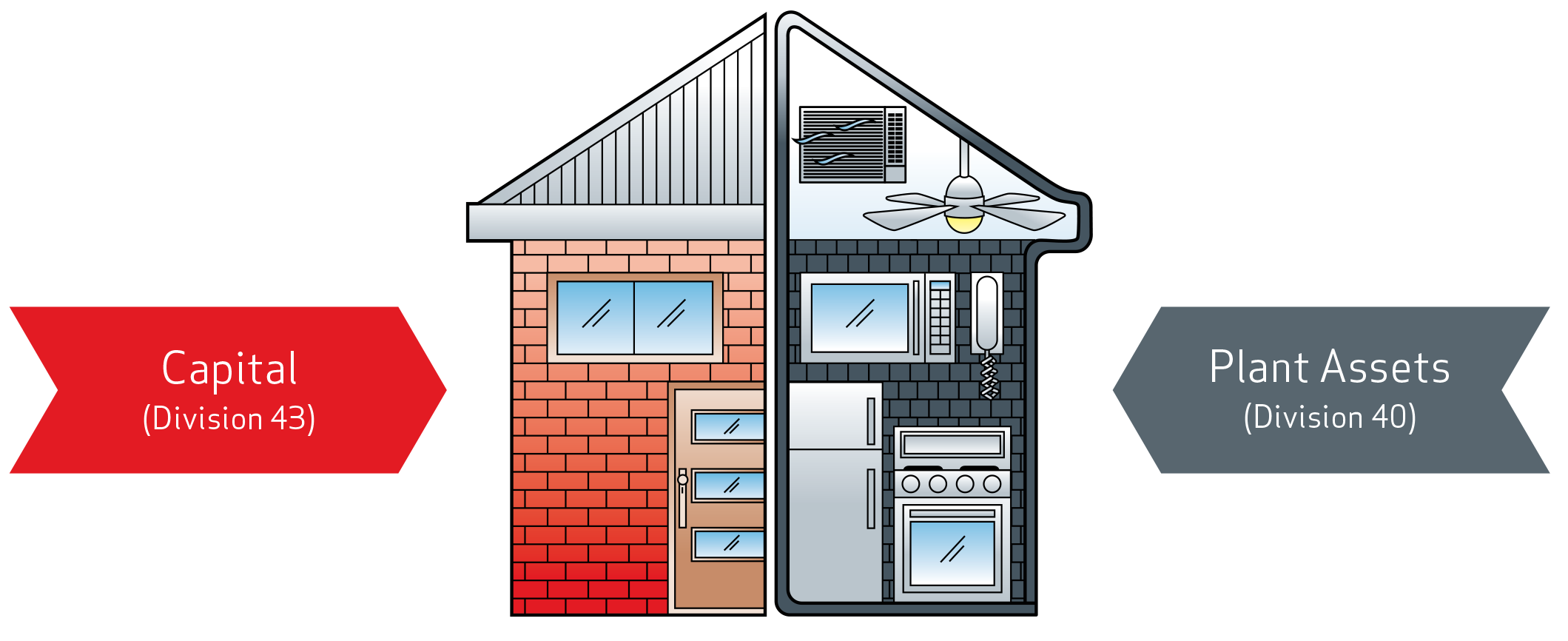

Simply, a Tax Depreciation Schedule / Quantity Surveyors Report is a document that lists out two different claims/allowances

1. The building capital (DIV43) which can be claimed as an allowance and

2. The plant (DIV40) which can be claimed as a depreciation expense.

The document schedules out both in relation to the financial years that they are owned by the investor and provides a total annual depreciation claim.

All investors and business owners that wish to claim depreciation when they submit their end of year tax returns, must provide their accountant with a tax depreciation schedule.

A tax depreciation schedule is for the lifetime of your ownership, and 100% tax deductible. You do not need to obtain a new schedule every year, but it is advisable that you consult with a member of our team before you make any changes to the property, pre and post depreciation schedule. As it could lead to you missing out on claiming beneficial tax deductions.

How much property depreciation deductions can I claim?

How much you can deduct through a tax depreciation report/schedule depends on four factors:

1. Plant Assets, (DIV 40) the value of the plant asset items bought with the property at settlement. (plant assets are items that do not form an integral part of the building’s structure).

2. Building Allowance, (DIV 43) the historical cost of the building structure. (what the building element cost at the date it was built)

3. Pre-Purchase Renovations or Extensions, the historical cost of any improvements to the original structure of the property made by the previous owners.

4. Post-Purchase Expenditure is the cost of any expenditure by the current owner after the settlement date of the property transfer.